Our Story

Innovation. Sustainability.

Customer Solutions Focus.

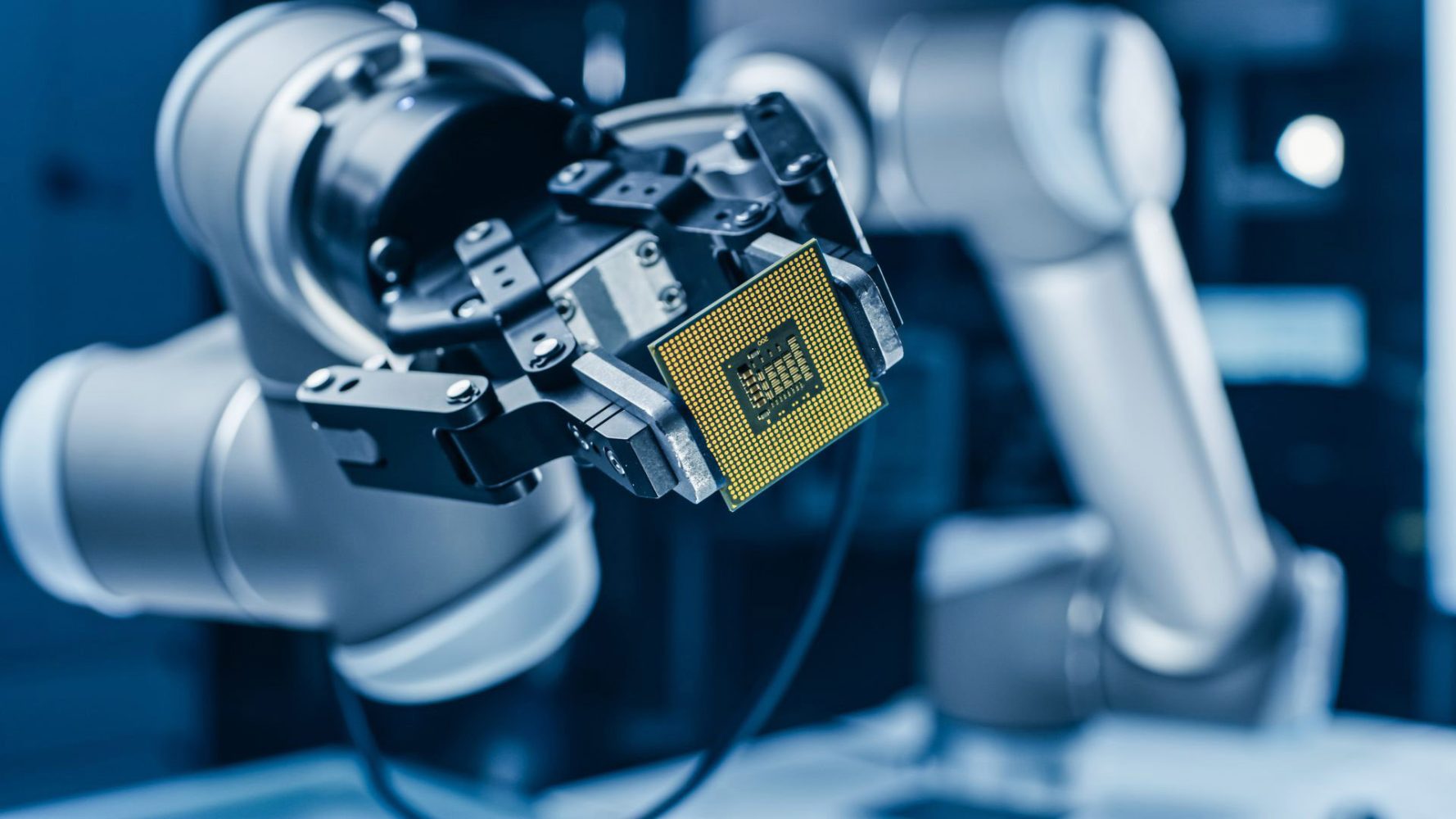

Masan High-Tech Materials’ vision is to become a leading global integrated supplier of high-tech advanced materials critical to global innovation. Through the application of our materials, we will create unparalleled solutions to drive innovation and productivity which will deliver superior outcomes for all our partners and stakeholders.

Products

Tungsten

Tungsten is a strategically important refractory metal. With its unique physical and chemical properties, Tungsten is applied in traditional heavy industries such as automotive, mechanical engineering and toolmaking, oil and gas industry, medical technology, aerospace, chemical industry, as well as electronics.

Read moreFluorspar

Fluorspar is an industrial mineral from which the element Fluorine is liberated, with two major downstream uses; the production of Hydrofluoric Acid (HF) which is used as a building block for Fluorine Chemicals, and the production of Aluminium Fluoride (AlF3) which is an important additive for the production of Aluminium by electrolysis.

Read more