Historically, Vietnam relied primarily on agriculture as a source of output, but has shifted towards a more market-oriented economy since the initiation of the "Doi Moi” (renovation) socialist-economic reform in 1986 and joining the World Trade Organization in 2006. These market liberalizations have helped Vietnam become one of the fastest growing economies in the region with an annual GDP growth rate (CAGR) of 7.8% between 2005 and 2012. The Vietnamese population has benefited from the strong economic growth.

The Vietnamese economy is projected to be one of the fastest developing economies in Asia, largely propelled by having:

- One of the youngest demographic profiles in Asia with high trainability; nearly 70% of the country’s approximately 90 million people are under 30 years of age

- The highest projected real GDP growth in the region over the next 5 years with average growth of 7%

- One of the world’s leading markets for consumer confidence with retail sales growth of 24% in 2011 and real consumer expenditure accounting for 64% of GDP in 2012 (Source: World Bank)

- Structural reforms that have improved Vietnam’s business environment and have supported growth in foreign and private investment

- A generous endowment of natural resources including oil, minerals and productive land

- Political stability and openness to foreign direct investment

Improving per capita income has fuelled Vietnam’s domestic consumption, which has been a solid growth driver despite external economic turbulences over recent years. AC Nielsen ranks Vietnam as having the highest growth rate in the consumer goods sector in Asia in 2012, up by 23% compared to India’s increase of 18% and China’s rise of 13%. Domestic consumer demand is expected to continue to benefit from the combined effects of favorable demographics, greater urbanization, a rise in disposable incomes and consumer leverage.

Vietnam has the third largest population in Southeast Asia, with nearly 70% belonging to the working age group (15-60). Vietnam's demographic presents an excellent opportunity for the rise in domestic consumer demand and is expected to persist through the next 30 years. There are other trends allied to these demographic realities that could result in structural changes in the consumer market, including: greater demand for convenience foods, greater focus on quality and health aspects of products, consolidation and greater preference for branded products, and demand for new products and variants.

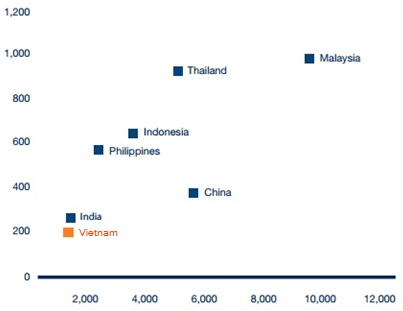

The food and beverage sector is a critical focal area as it is underpinned by the rising living standards of Vietnamese families and is underpenetrated in comparison to Asia-Pacific peers. On a per capita basis, spending on packaged foods and beverages in Vietnam is still relatively low compared to its emerging market peers, demonstrating the significant growth potential of the market. According to Euromonitor, per capita expenditure on food and non-alcoholic beverages is expected to grow at 7% per annum from 2012 to 2016, reaching US$276 by 2016. We expect future growth to be driven by the continuing change in urban consumer lifestyle as they place a higher importance on convenience, safety and health. In addition, rising consumption of branded FMCG products in rural Vietnam will drive market growth as rural consumers have better access to products backed by higher levels of disposable income.

Per-capita expenditure on food and

non-alcoholic beverages 2011 (US$)

GDP per capital (US$)