Convenience foods

Instant Noodles

Overview

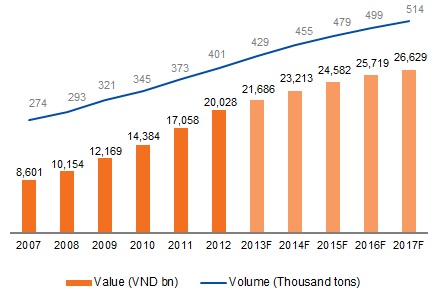

On a per capita basis, Vietnam’s instant noodles consumption is estimated to be the third highest in the Asia Pacific region, only trailing South Korea and Indonesia. Vietnam’s instant noodles market is forecasted to reach approximatelyVND26,629 billion by 2017. The market can be sub-divided into two segments: packet noodles (dry noodles sold in plastic packets which consumers must cook in a separate pot) and cup/bowl noodles.

Instant noodles market sales and volume data (2007-2017F)

Source: Euromonitor as of Mar 2013

In 2012, instant noodles grew by 17% in current value terms. This indicates that instant noodles maintained strong growth in 2012 and demand was not affected by changes in the economic situation, which may be attributed to the low price points of instant noodles and strong demand from a large young population for whom convenience is important.

Growth Prospects

The following factors will drive growth in the instant noodles market:

- Continued focus on convenience and premium products - The popularity of the instant noodles is likely to increase as young Vietnamese professionals demand ease of preparation. Consumers will increasingly shift to premium products whose higher price points will boost the overall market size.

- Product breadth and positioning - Consumers’ search for variety and healthier substitutes is an ongoing trend in the instant noodles market. To combat the traditional perception that the product is a junk food and that overconsumption could lead to health concerns such as pimples and indigestion, producers will continue to increase product variety and flavors, and introduce healthier non-flour-based noodles.

Competition

Vietnam’s instant noodles market is extremely competitive, with the steady introduction of brands providing consumers with a wide variety of choices. Companies have invested heavily in advertising and research and development in order to consolidate market share and clearly differentiate their products from the market.